4. Financial analysis#

[1]:

import numpy as np

import matplotlib.pyplot as plt

from relife import Gompertz, AgeReplacementPolicy, OneCycleAgeReplacementPolicy

[2]:

a0 = np.array([15, 20, 25]).reshape(-1, 1) # Ages initiaux des actifs

cp = 10 # Cout d'un rempalcement préventif

cf = np.array([900, 500, 100]).reshape(-1, 1) # Cout d'un rempalcement sur défaillance

discounting_rate = 0.04 # taux d'actualisation

distribution = Gompertz(shape=0.00391, rate=0.0758) # Modèle de durée de vie des actifs

# Remplacement par âge sur une infinité de cycles

ar_policy = AgeReplacementPolicy(

distribution, cf=cf, a0=a0, cp=cp, discounting_rate=discounting_rate

)

ar_policy.fit(inplace=True)

ar_policy.ar1, ar_policy.ar

[2]:

(array([[ 7.82608906],

[ 9.06699905],

[19.02758643]]),

array([[20.91316269],

[25.54310597],

[41.59988035]]))

[3]:

# Remplacement par âge sur un cycle

onecycle_ar_policy = OneCycleAgeReplacementPolicy(

distribution, a0=a0, cf=cf, cp=cp, discounting_rate=discounting_rate

)

onecycle_ar_policy.fit(inplace=True)

onecycle_ar_policy.ar

[3]:

array([[ 7.82608906],

[ 9.06699905],

[19.02758643]])

[4]:

distrib = Gompertz(shape=0.2, rate=0.1)

distrib.mean(), distrib.var()

[4]:

(array(14.93348747), np.float64(60.372106915294125))

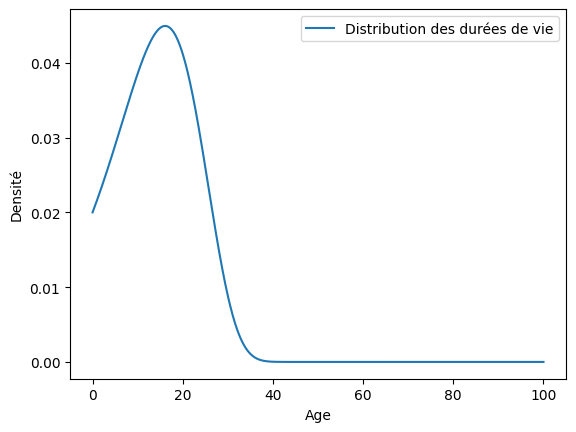

[5]:

t = np.linspace(0, 100, num=1000)

ax = distrib.plot.pdf(t, label="Distribution des durées de vie")

ax.set_xlabel("Age")

ax.set_ylabel("Densité")

plt.show()

[6]:

ar_policy = AgeReplacementPolicy(distrib, cf=cf, cp=cp, discounting_rate=discounting_rate)

ar_policy.fit(inplace=True)

optimal_ar = ar_policy.ar

print(optimal_ar)

[[3.11636797]

[4.10385822]

[8.61449029]]

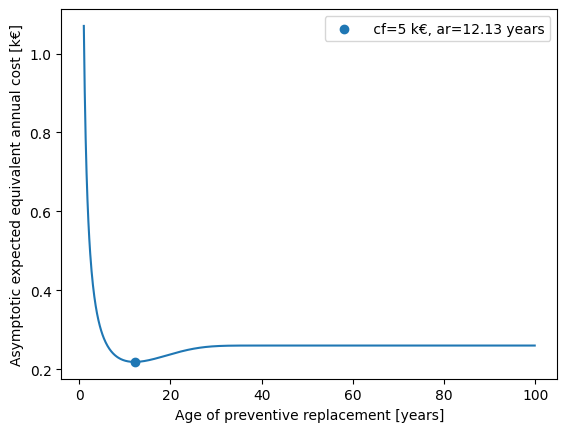

[7]:

cp = 1

cf = 5

discounting_rate = 0.05

ar = np.arange(1, 100, 0.1).reshape(-1, 1) # range of ar

ar_policy = AgeReplacementPolicy(

distrib, cf=cf, cp=cp, ar=ar, discounting_rate=discounting_rate

)

za = ar_policy.asymptotic_expected_equivalent_annual_cost()

ar_policy.fit(inplace=True)

ar_opt = ar_policy.ar # optimal ar

za_opt = ar_policy.asymptotic_expected_equivalent_annual_cost()

plt.plot(ar, za)

plt.scatter(ar_opt, za_opt, label=f" cf={cf} k€, ar={np.round(ar_opt, 2)} years")

plt.xlabel("Age of preventive replacement [years]")

plt.ylabel("Asymptotic expected equivalent annual cost [k€]")

plt.legend()

plt.show()

print("asymptotic expected equivalent annual cost with optimal ar :", za_opt)

asymptotic expected equivalent annual cost with optimal ar : [[0.21905383]]

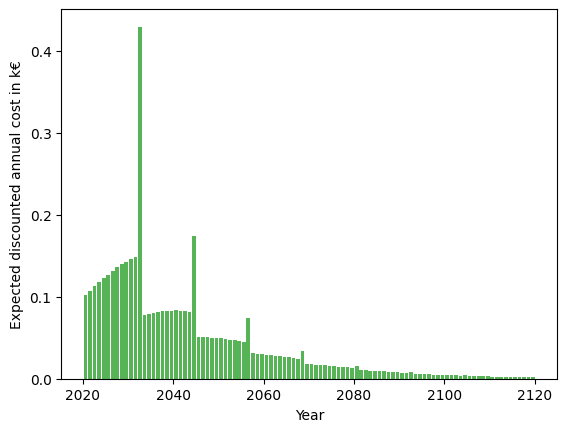

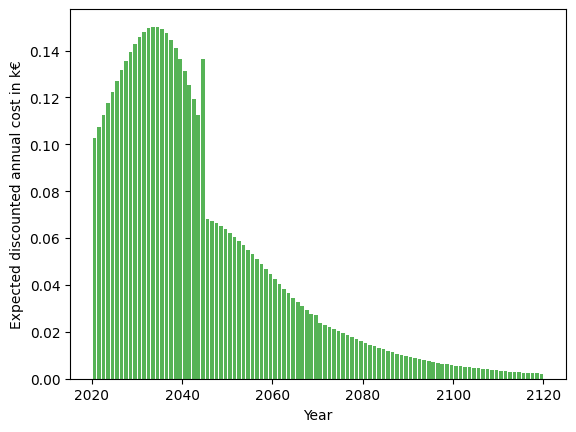

[8]:

dt = 0.5

step = int(1 / dt)

t = np.arange(0, 100 + dt, dt)

z = ar_policy.expected_total_cost(t)

y = t[::step][1:]

q = np.diff(z[::step])

plt.bar(2020 + y, q, align="edge", width=-0.8, alpha=0.8, color="C2")

plt.xlabel("Year")

plt.ylabel("Expected discounted annual cost in k€")

plt.show()

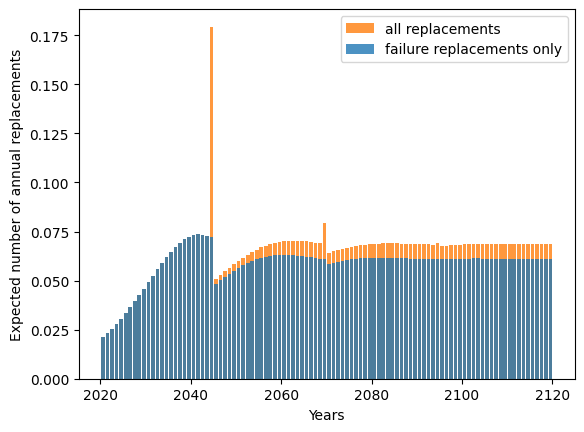

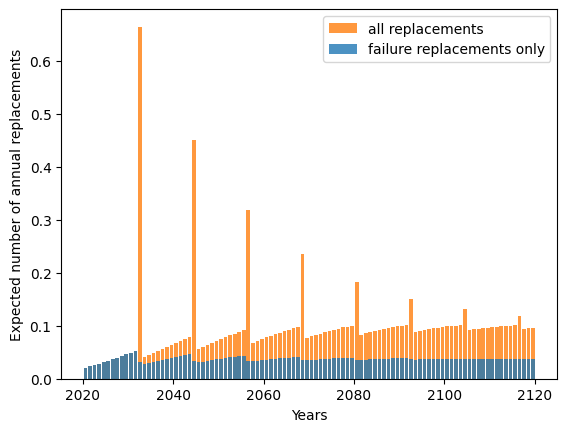

[9]:

policya = AgeReplacementPolicy(distrib, cf=1, cp=1, ar=ar_opt, discounting_rate=0)

policyb = AgeReplacementPolicy(distrib, cf=1, cp=0, ar=ar_opt, discounting_rate=0)

mt = policya.expected_total_cost(t)

mf = policyb.expected_total_cost(t)

qt = np.diff(mt[::step])

qf = np.diff(mf[::step])

plt.bar(

y + 2020,

qt,

align="edge",

width=-0.8,

alpha=0.8,

color="C1",

label="all replacements",

)

plt.bar(

y + 2020,

qf,

align="edge",

width=-0.8,

alpha=0.8,

color="C0",

label="failure replacements only",

)

plt.xlabel("Years")

plt.ylabel("Expected number of annual replacements")

plt.legend()

plt.show()

[10]:

# Choix d'une stratégie de remplacement a priori, sans calcul d'optimalité.

ar = 25

# Projection des conséquences de la stratégie

sub_opti_ar_policy = AgeReplacementPolicy(

distrib, cf=cf, cp=cp, ar=ar, discounting_rate=discounting_rate

)

# Cout de long terme de la stratégie

print(sub_opti_ar_policy.asymptotic_expected_equivalent_annual_cost())

# Distribution des coûts de la stratégie au cours du temps

dt = 0.5

step = int(1 / dt)

t = np.arange(0, 100 + dt, dt)

z = sub_opti_ar_policy.expected_total_cost(t)

y = t[::step][1:]

q = np.diff(z[::step])

plt.bar(2020 + y, q, align="edge", width=-0.8, alpha=0.8, color="C2")

plt.xlabel("Year")

plt.ylabel("Expected discounted annual cost in k€")

plt.show()

[[0.25232943]]

[11]:

policya = AgeReplacementPolicy(distrib, cf=1, cp=1, ar=ar, discounting_rate=0)

policyb = AgeReplacementPolicy(distrib, cf=1, cp=0, ar=ar, discounting_rate=0)

# Distribution des remplacements de la stratégie au cours du temps

mt = policya.expected_total_cost(t)

mf = policyb.expected_total_cost(t)

qt = np.diff(mt[::step])

qf = np.diff(mf[::step])

plt.bar(

y + 2020,

qt,

align="edge",

width=-0.8,

alpha=0.8,

color="C1",

label="all replacements",

)

plt.bar(

y + 2020,

qf,

align="edge",

width=-0.8,

alpha=0.8,

color="C0",

label="failure replacements only",

)

plt.xlabel("Years")

plt.ylabel("Expected number of annual replacements")

plt.legend()

plt.show()